good post. if you do some checking you will see lincoln did the same thing with the greenbacks, so he could fund the civil war interest free! here is some more interesting info the link

Andrew Jackson 'Kills the Bank'

President Jackson was an advocate of sound monetary policies as outlined in the U.S. Constitution. He opposed the central bank system of issuing currency against debt.

Jackson had an investigation done on the Second Bank of the United States which he said established "beyond question that this great and powerful institution had been actively engaged in attempting to influence the elections of the public officers by means of its money."

In 1832, Andrew Jackson's re-election slogan was "JACKSON and NO BANK!" On July 10, 1832 President Jackson vetoed congress' decision to renew the charter of The Second Bank of The United States.

"It is not our own citizens only who are to receive the bounty of our government. More than eight millions of the stock of this bank are held by foreigners... is there no danger to our liberty and independence in a bank that in its nature has so little to bind it to our country? ... Controlling our currency, receiving our public moneys, and holding thousands of our citizens in dependence... would be more formidable and dangerous than a military power of the enemy." (President Andrew Jackson - July 10, 1832)

In 1833, President Andrew Jackson instructed his Secretaries of the Treasury to cease depositing funds to the bank. Two refused to obey, so he fired them, one after the other, until he got one who did: Roger B. Taney, his former Attorney General and the future Supreme Court Chief Justice.

In 1835, Jackson paid off the final instalment on the national debt. He was the first and only president to ever accomplish this. A few weeks later, Richard Lawrence tried to shoot Jackson. However, both revolvers failed and he was arrested and tried but was found not guilty by reason of insanity. Allegedly, he spoke to several friends that wealthy people in Europe had put him up to it and promised to get him released if he was caught.

Abraham Lincoln

In order to finance the North's Civil War efforts, Lincoln approached the European banks controlled by the Rothschilds in 1861. They demanded 24% to 36% interest. Lincoln refused and instead passed the Legal Tender Act of 1862. Under this new piece of legislation, Lincoln issued US$449,338,902 of interest-free money, known as Greenbacks, so-called from the green ink they used. It served as legal tender for all debts, public and private and was used to finance the Union's Civil War efforts.

"The government should create, issue and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers ... The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government's greatest creative opportunity. By the adoption of these principles, the long-felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest..." (Abraham Lincoln)

An editorial in the London Times reveals sentiment of the European bankers,

"If this mischievous financial policy, which has its origin in North America, shall become endurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous without precedent in the history of the world. The brains, and wealth of all countries will go to North America. That country must be destroyed or it will destroy every monarchy on the globe." ( London Times , 1865)

By the end of 1863, Congress had authorized the printing of US$850 million worth of Greenbacks. Private banks used these Greenbacks as bank reserves, against which the issued their own bank notes and demand deposits. Over the course of the U.S. Civil War the money supply went from $45 million to $1.77 billion. Prices subsequently skyrocketed.

In 1863, Congress passed the National Bank Act from which point forward, all money in circulation would be created out of debt from bankers buying U.S. government bonds in exchange for bank notes. By 1865, the national banks had 83 percent of all bank assets in the United States.

Lincoln was assassinated by John Wilkes Booth on April 14, 1865, just five days after Lee surrendered to Grant. On April 12, 1866, Congress passed the Contraction Act which called for retiring Lincoln's greenbacks from circulation as soon as they came back to the Treasury in payment of taxes.

Assassination of President Garfield

President James A. Garfield was inaugurated in 1881 and was the second American president to be assassinated. He was shot by Charles J. Guiteau on July 2, 1881 and later died from medical complications on September 19. Two weeks before being shot, President Garfield is attributed with saying,

"Whoever controls the volume of money in our country is absolute master of all industry and commerce...and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate." (President James A. Garfield, 1881)

Panic of 1907

Three failed attempts of establishing a central bank in the United States did not dissuade a fourth. By the beginning of the 20 th century the most influential business men and bankers were the J.D. Rockefeller, J.P. Morgan, Paul Warburg, and the Rothschilds.

The Panic of 1907 was a run on the American banking system as a result of a public announcement by J.P. Morgan that a prominent bank in New York was insolvent. The results were wide-spread mass withdrawals on the entire banking system. This forced the banks to call in their loans. Bankruptcies, repossessions and financial turmoil emerged.

Congress created the National Monetary Commission after the Panic of 1907 to draft up a plan for banking reform. Nelson Aldrich headed the Commission that comprised of two components - one to study the European central banking systems headed by Aldrich himself and another to study the American monetary system.

Centralized banking was met with much opposition from the American public, who were suspicious of a central bank and who charged that Aldrich was biased due to his close ties to wealthy bankers such as J.P. Morgan and his daughter's marriage to John D. Rockefeller, Jr.

Creation of the Federal Reserve

Allegedly, in exchange for financial support for his presidential campaign, Woodrow Wilson agreed that if elected, he would sign a bill that would lead to the formation of a central bank for the United States.

On 1910, a secret meeting took place on the Morgan estate on Jekyll Island, Georgia. Aldrich met with representatives of prominent banking firms. Such men included Henry Davison (senior partner of J.P. Morgan Company), Frank Vandelip (President of the National Bank of New York associated with the Rockefellers), Charles D. Norton (president of the Morgan-dominated of First National Bank of New York), Benjamin Strong (representing J.P. Morgan), and the primary architect of the Act, Paul Warburg (representing Kuhn, Loeb & Co.)

Over a period of ten days they drafted the Federal Reserve Act that was voted on in Congress on Monday 22 December 1913 between the hours of 1:30 am to 4:30 am when much of Congress was either sleeping or at home with their families for the Christmas holidays. It passed through the Senate the following morning and Woodrow Wilson signed the bill into law later that same day at 6:02 pm. This Act transferred control of the money supply of the United States from Congress as defined in the U.S. Constitution to the private banking elite.

The deceptive terminology of the name was carefully chosen because the American public did not want a central bank similar to those in Europe. The Federal Reserve is not a federal governmental entity nor is it a reserve, such as a governmental treasury, backing up its currency. The Federal Reserve is a legalized cartel of the money supply owned by private national banks, operating for the benefit of the few under the guise of protecting and promoting public interests.

The meeting on Jekyll Island remained unknown to the public until Forbes magazine founder Bertie Charles Forbes wrote an article about it in 1916, three years after the Federal Reserve Act was passed.

Wilson wrote in his book, The New Freedom ,

"A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men ... [W]e have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world--no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men." (Woodrow Wilson, The New Freedom: A Call for the Emancipation of the Generous Energies of a People )

A central banking system wherein every dollar created is an instrument of debt requires the collection of large sums of money from the people to pay off the interest. Interestingly, 1913 was also the year that introduced the Sixteenth Amendment, thereby giving government the power to collect taxes based on income.

World War I

In 1914, when war broke out in Europe, the American public did not want to become involved. While President Woodrow Wilson publicly declared that the United States would remain neutral, efforts were being made behind the scenes to ensure America's entry into the war.

Wars are extremely profitable for central bankers because it forces the governments to further borrow addition money at interest. Secretary of State, William Jennings Bryan wrote, "the large banking interests were deeply interested in the world war because of the wide opportunities for large profits."

Allegedly on May 7, 1915 the Lusitania, an ocean-liner carrying American passengers, was deliberately sent into German controlled waters. The German Imperial embassy paid to have a warning ad in fifty East Coast newspapers, including those in New York, stating that anyone boarding the Lusitania would be doing so at their own risk . The ad appeared only in the Des Moines Register .

As expected, a German U-boat torpedoed the Lusitania. German records indicate that a large secondary explosion followed the torpedo hit leading some to speculate the storing of ammunition. As a result 1,198 people of the 1,959 aboard lost their lives and the U.S. shortly entered the war thereafter.

The First Moves of the Federal Reserve

The public was told that the creation of the Federal Reserve would stabilize the economy. From 1914-1919 the money supply nearly doubled. This resulted in extensive loans to small businesses and the public. A calling in of the loans in 1920 resulted wide-spread bankruptcies and bank-runs marking the steep 1920-1 recession. Over 5400 independent and competitive private banks outside of the Federal Reserve System collapsed thus consolidating the power of the central banks.

The Harding administration did not intervene despite political pressure to do so. Harding's approach to the problem was, "the banks got themselves into this mess, so let them get themselves out of it." Since the Harding administration public management of the economy has emerged as a primary activity of the government.

President Harding was the sixth president to die while in office. It was during his "Voyage of Understanding", during which he was returning from Alaska. The official cause of death as stated in the New York Times was, "a stroke of apoplexy". Gaston B. Means, an amateur historian and gadfly, noted in his book The Strange Death of President Harding (1930) that the circumstances surrounding his death lend themselves to speculation he had been poisoned.

The Great Depression

From 1921 to 1929 the Federal Reserve increased the money supply by 62% thus fuelling the period known as the Roaring Twenties. Further fuelling the rise in stock market indices was a new type of loan, known as a margin loan , whereby an investor would only need to put down 10% of the value of a stock with the remaining 90% being loaned from the broker. Like today, these loans could be called in at any time and had to be paid within 24 hours, known as a margin call . This is typically accomplished by the selling of the stock purchased using the loan.

These two factors, loose monetary policy and easy loans resulted in a fivefold increase in the Dow Jones Industrial Average over the latter half of the 1920's.

The mass calling in of these margin loans by the New York banking establishment resulted in the devastating market crashes of October of 1929. "Black Thursday", the initial crash, occurred on October 24. The crash that caused general panic five days later on October 29 was known as "Black Tuesday".

Then, instead of expanding the money supply, the Federal Reserve contracted it, thereby creating the period known as the Great Depression. Congressman Wright Patman in A Primer On Money , reported that the money supply decreased by eight billion dollars from 1929 to 1933, causing 11,630 banks of the total of 26,401 in the United States to go bankrupt. This allowed central bankers to buy up rival banks and whole corporations at a deep discount.

It is interesting to note that biographies of J.P. Morgan, Joe F. Kennedy, J.D. Rockefeller and Bernard Baruch indicate that they all managed to transfer their assets out of the stock market and into gold just before the crash of 1929.

Legend has it that Joseph P. Kennedy decided to sell his considerable stock holdings after hearing an investment tip from a shoe-shiner. Joe Kennedy went from having $4 million in 1929 to over $100 million in 1935.

One must wonder if that 'shoe-shiner' was Paul Warburg, a founder and original member of the Federal Reserve warning of the coming collapse and depression in an annual report to the stockholders of his International Acceptance Bank,

"If the orgies of unrestrained speculation are permitted to spread, the ultimate collapse is certain not only to affect the speculators themselves, but to bring about a general depression involving the entire country." (Paul Warburg, March 1929)

On June 10, 1932, Congressman Louis McFadden, a long-time adversary to the Federal Reserve, made a 25-minute speech before the House of Representatives, in which he accused the Federal Reserve of deliberately causing the Great Depression.

In 1933, McFadden introduced House Resolution No. 158, Articles of Impeachment for the Secretary of the Treasury, the Comptroller of the Currency, and the Board of Governors of the Federal Reserve, for numerous criminal acts, including but not limited to, conspiracy, fraud, unlawful conversion, and treason.

Louis McFadden died in Oct 3, 1936 during a visit to New York City. The official reason of death was "heart-failure sudden-death", after a "dose" of "intestinal flu."

There were previously two alleged attacks on McFadden's life. The first came in the form of two revolver shots when he was in a cab outside one of the Capitol hotels. Both shots missed their intended target. The second was when he became violently ill after a political banquet at Washington. He was saved from a physician friend at the same banquet that procured a stomach pump and gave McFadden emergency treatment.

Seizure of the American Publics' Gold

Under the pretense of helping to end the Great Depression came the 1933 Gold Seizure whereby the Roosevelt Administration outlawed private ownership of gold. Under the threat of imprisonment for 10 years, a US$10,000 fine or both, everyone in America was required to turn in all gold bullion to the U.S. Treasury.

The rationale for the seizure was that the declining prices of the Great Depression were a direct result of overcapacity. This flawed reasoning resulted in the creation of disastrous policies such as National Industrial Recovery Act where business cartels were deliberately constructed to keep prices high and the Agricultural Adjustment Act that ordered mass destruction of livestock and crops in order to reduce supply and drive up prices. In a time when unemployment is at record highs and people are suffering from economic hardship, these policies are the complete opposite of what is required.

As a final component to the Roosevelt Administration's desire to increase prices was to devalue the dollar. To do so required that the dollar be uncoupled from gold. As long as the dollar was tied to a gold standard, the amount of money in circulation could not dramatically increase as the public would convert the paper into gold when they became aware of the over-issuance of paper currency.

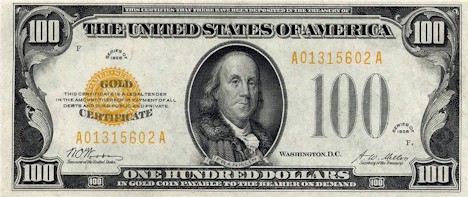

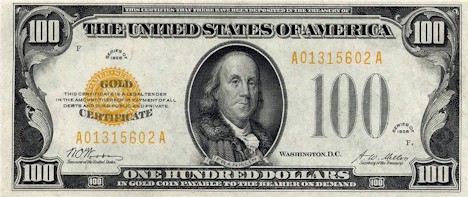

Example of a US$100 gold certificate from the late 1920's

On April 5, 1933, Roosevelt signed Executive Order 6102, which ordered people to turn in their gold to the government at payment of $20.67 per ounce. Individuals could hold up to $100 in gold coins, and there were some exceptions for dental use, jewelry, and artists and others who used gold in their jobs.

While U.S. citizens could be ordered not to hoard gold, Roosevelt knew he could not impose such a law on sovereign nations. Foreigners could still exchange there U.S. dollars for gold, but shortly after issuing Order 6102, Roosevelt devalued the dollar to US$35 per ounce thereby decreasing the value of the dollar overnight by 40.94%.

The result of these policies allowed greater ability of the Federal Reserve to increase the amount of money in circulation thereby increasing their revenue from interest.

World War II

"The question was how should we maneuver them [Japan] into firing the first shot... it was desirable to make sure the Japanese be the ones to do this so that there should remain no doubt as to who were the aggressors." (Henry Stimson, U.S. Secretary of War prior to WWII, Nov. 25, 1941 in a journal documenting his conversation with President Roosevelt)

Franklin Delano Roosevelt's uncle, Frederic A. Delano, was appointed by Woodrow Wilson to the First Federal Reserve Board on August 5, 1914. Roosevelt may have been sympathetic to the central bankers desire for American entry into the Second World War. There exists some suggestive evidence that the Roosevelt administration provoked the Japanese into attacking American forces stationed at Pearl Harbor.

In 1940, FDR ordered the pacific fleet transferred from the West Coast to Hawaii. Admiral Richardson complained of inadequate protection from both air and torpedo attack. He twice disobeyed orders to berth the fleet there and was replaced by Admiral Kimmel, who later brought up the same issues.

On October 7, 1940, Lieutenant Commander Arthur McCollum wrote an eight page memo describing a process to force Japan into war with the U.S.

On February 11, 1941, FDR proposed sending six cruisers and two carriers to Manila.

It is generally agreed that the U.S. oil embargo on Japan lead promptly to the Japanese invasion of the Dutch East Indies.

Roosevelt further antagonized Japan by freezing all of the Japanese assets in the United States, supplied financial aid to Nationalist China and military aid to the British in violation to the existing international war rules.

On Dec 4, three day prior the attack on Pearl Harbor, Australian intelligence warned Roosevelt of a Japanese task force moving towards Pearl Harbor.

The attack resulted in the deaths of 2,400 American soldiers and resulted in the entry of the United States into the war. Before the attack on Pearl Harbor, 83% of the American public did not want to enter the war. After the attack, one million men volunteered for the military service.

Bretton Woods Agreement

The United States had emerged from the Second World War as a dominant world power both militarily and economically. It had grown wealthy selling weapons and lending money to both sides of the war. In 1945, the U.S. produced half the world's coal, two-thirds of the oil, and more than half of the electricity. The U.S. manufacturing industry was able to produce great quantities of machinery, including ships, airplanes, vehicles, armaments, machine tools, and chemicals. In addition, the U.S. held over 65% of world's gold reserves and was the sole possessor of the atomic bomb.

Delegates from 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire for the United Nations Monetary and Financial Conference during the first three weeks of July 1944. The purpose of the conference was to establish the rules for commercial and financial relations amongst the world's major industrial states. The agreements signed at this conference became known as the Bretton Woods Monetary System.

The Bretton Woods Monetary System was basically a pegged rate currency exchange system with the U.S. dollar functioning as the underlying currency. All countries would peg their currency to the U.S. dollar and would buy and sell U.S. dollars to keep the market exchange rates within a trading band of plus or minus 1% from the original ratio. The U.S. dollar would be convertible into gold at a rate of US$35 per troy ounce. In effect, the U.S. dollar took over the role held by gold under the previous international gold standard financial system.

The U.S. has enjoyed an enormous advantage of such a system because they are the only entity legally capable of creating more of the reserve currency, that being U.S. dollars. Other nations were forced to buy large amounts of U.S. dollar reserves to maintain their currency within the trading band.

John Fitzgerald Kennedy

On June 4, 1963, John F. Kennedy signed a virtually unknown Presidential decree, Executive Order 11110 , a mere four months before his assassination on November 22, 1963. This decree returned to the U.S. Federal government the Constitutional right to create and "to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury."

As a result, US$4,292,893,815 of new "Kennedy Bills" were created through the U.S. Treasury instead of the Federal Reserve System. In 1964, Kennedy's successor, Lyndon B. Johnson, stated that, "Silver has become too valuable to be used as money." The Kennedy bills were removed from circulation.

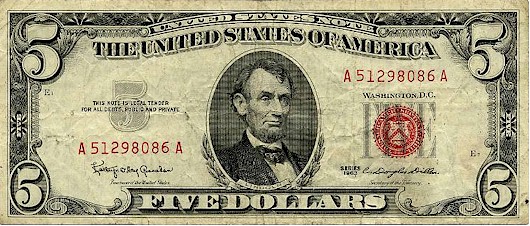

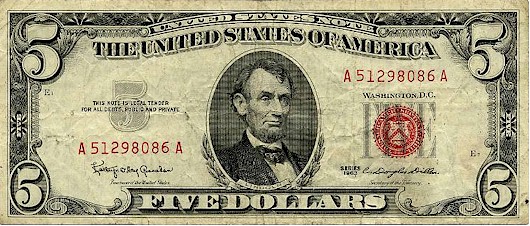

Below are examples of the $2 and $5 dollar denominated "Kennedy Bills" (also known as "Red Seal Bills"). Note the 1963 date and words "United States Note" at the top instead of the familiar "Federal Reserve Note" wording. (Click on image to enlarge).

The importance of these bills is not to be underestimated. The regular Federal Reserve Notes are created through the Fed who exchanges them for an interest-paying government bond. These "United States Notes" were directly created through the U.S. Treasury and backed by the silver held there.

There was no interest to be paid on these bills by the government (or more correctly, by the tax-payer) to the Federal Reserve.